by: Lana Clements

- 0

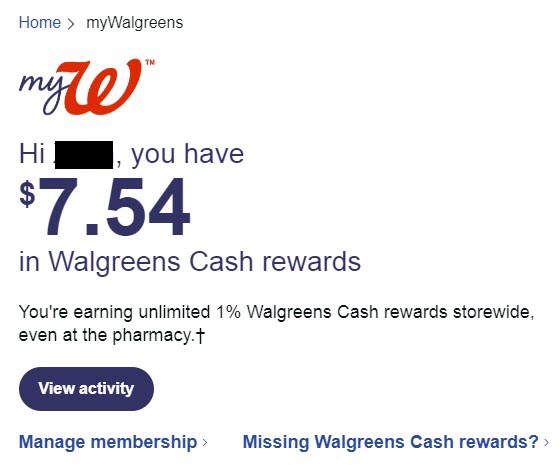

Regulatory legislation on the Economic Conduct Authority (FCA) do not indicate one to lender comments is employed to assess affordability, however, loan providers will utilize them to confirm earnings, including outgoings.

many banks has actually privately gone of this approach and you may was as an alternative relying on credit reporting, certainly one of almost every other mode, to evaluate appropriate consumers.

The financial institution extra that if requested to send an announcement so you’re able to make sure, instance, gurus otherwise salary, advisors will be merely publish the fresh new unmarried page on which the cash entryway try presented.

Financial comments carry out underwriting trouble

Financial statements throw up all types of additional difficulties inside the an software, that’s the reason some loan providers may stay away from deciding on him or her, advisers suggested.

Nick Morrey, product technical movie director on representative John Charcol, said while some lenders do not request statements, they aren’t necessarily advertisements it.

He added: What they want observe in the beginning is the fact the fresh new salary announced on payslip is what gets into the brand new checking account, and that’s understandable to have possible ripoff explanations.

But when they are considering a financial statement he’s to review it securely and this function considering all deals to find out if you will find something that the lending company you can expect to come across since a problem.

Malcolm Davidson, managing director at the mortgage broker United kingdom Moneyman, questioned whether loan providers really want to understand the entire realities about potential borrowers.

Rachel Lummis away from Xpress mortgages told you even when lenders may well not inquire about the fresh new files, it is far from an excellent get out of jail card’ for consumers.

She extra: Brand new adviser will require financial statements getting determining cost, indicating money and you can compliance motives and financial totally needs the newest adviser to have him or her for the file.

She said: Whether or not the lending company need a lender statement, I’m able to however see 3 months to enhance my personal file.

I got an instance just has just where We examined my customers lender comments and then he got more than 50 playing deals during the a three months period.

We managed to get clear towards visitors he risked becoming rejected in the event your lender got an issue with them.

In addition made certain which i assigned ?600 on their funds, of course he went on this new routine. The loan experience perfectly, not my conformity cards made sure this particular question try showcased and i also had considered the newest impression from the.

The reduced the mortgage so you can worthy of, the fresh faster files generally speaking required by the financial institution… However it does not mean the fresh new adviser doesn’t need to carry out the jobs of your financial because of the grilling the clients and achieving good an effective compliant file so you can ring fence all of it.

There is absolutely no needs one to a brokerage must inquire about lender statements out of a debtor since the evidence of cost, however, given that advisors listed it does render proof the viability away from demanded revenue.

The financial institution is responsible for conforming for the regulator’s lending legislation and you will making certain new borrower have enough money for pay back the mortgage.

Regarding kilter having Open Banking

Sebastian Riemann, agent at the Libra Financial Planning, said: Loan providers will be able to scrutinise every purchasing patterns and you can activities and it is likely that some that would as a rule have certified, upcoming slip outside of lenders conditions.

Davidson suggested avoiding financial comments is off kilter into the concept of Open Banking and you will requested exactly how these businesses commonly work with the newest environment.

The guy told you: Unlock banking is going to result in that it slicker mortgage procedure but loan providers don’t want to come across [the users ingoings and you can outgoings].

Good spokeswoman for Santander said: Agents provides fed right back that there surely is both uncertainty within the documentation that’s very important to for each app, causing even more records being needlessly collated and you can filed.

To support her or him, we sent an age-send clarifying the new documentation standards one to section of it was as much as protecting applicant’s financial statements.

As a prudent lender, we need to always ensure the required value inspections are executed with the intention that anybody obtain the product which suits their demands and are able the loan into the duration of the expression.

The brand new communication was designed to help brokers collect that was necessary getting unique instances, enabling them to easily and quickly have the right behavior to possess the client.

We have now have access to customer recommendations of credit bureaus, which can only help paint a picture of people, along with most recent membership return as an element of automatic earnings verification.

We greet anymore advice that Open Financial brings, our very own top priority was help agents and you can guaranteeing customers get the proper financial to fulfill their needs.

A good spokeswoman getting Halifax said it doesn’t inquire about lender comments given that loan providers fool around with multiple devices to evaluate a customer’s credit history, along with credit rating and you can a value analysis.

Many lenders affirmed they do nonetheless wanted bank statements, regardless if NatWest doesn’t require statements should your borrower has already been an effective buyers.

A representative to own Accord Mortgage loans told you: We are in need of a minumum of one bank declaration as an element of our mortgage app strategy to have the ability to confirm the precision and you can authenticity out-of a beneficial borrower’s earnings.

While we take note of a possible borrower’s outgoings, i get it done for the sake of both the debtor and you may ourselves to ensure he has got the ability to be able to repay the brand new assented monthly payment.

Such as for example, we have a look at constant economic obligations, that will indicate a debt repayment system which was before undeclared, otherwise if or not candidates are often times incapable of get free from its overdraft or whether or not around people signs of individuals staying in economic problem.